Having trouble picking a Shopify payments provider? We hear you. Choosing the right one is essential, but with so many options, it’s easy to get lost.

Don’t worry, though. As experienced Shopify specialists, GenovaWebArt has prepared a list of 10 tried-and-tested Shopify payment methods. But we don’t stop there.

We’ll help you select the best payment method for Shopify, breaking down the must-have features to consider. We’ll also tell you how to implement Shopify payments just like we did for Ten Thousand, Winky Lux, and numerous other brands.

Table of Contents

- 10 Best Shopify Payment Methods

- What to Consider When Choosing a Shopify Payment Gateway Solution

- Features to Consider When Choosing a Shopify Payment Method

- How to Integrate Payment Methods on Shopify

- Shopify Payments vs. Third-Party Providers

- Need to Personalize Your Shopify Store? Contact GenovaWebArt!

- FAQ

10 Best Shopify Payment Methods

Before you discover how to select the Shopify payment gateway, look at the options available. Below, you’ll find an overview of popular Shopify payment methods along with their features, pros, and cons.

1. Shopify Payments

One of the most cost-efficient, in-built solutions for Shopify websites, that can easily manage and process payments without involving any third-party solution. Its best features are real-time monitoring, advanced security, multi-currency support, and flexible subscription plans.

However, keep in mind that Shopify is available in a restricted number of countries and may withhold your money temporarily, which is not always convenient for business owners.

Pros:

- Comparatively low processing fees

- Quick and easy setup process

- Real-time transaction monitoring

Cons:

- Not available everywhere

- Potentially higher fees than in other providers

2. Shop Pay

Another common payment option for Shopify websites is transparent and easy to set, yet fits both local and international transactions. Similar to PayPal, it supports various payment options and currencies and has a highly customizable checkout flow.

Additionally, you don't have to pay for the setup or cancellation with Shop Pay! But this platform has a comparatively steep learning curve and is only available in up to 40 countries, which might not fit your eCommerce model.

Pros:

- Simplified merchant checkout process

- Low fees for sellers

- Increased customer loyalty and retention

- Various payment options available

Cons:

- Designed exclusively for Shopify

- Limited availability in different countries

3. PayPal

A decent alternative to Shopify payments trusted by over 220 million customers across the globe. It features both paid and free plans for Shopify store owners, supports a wide range of currencies, and has an intuitive mobile interface.

Paypal's most notable drawback is the inconsistent customer service and periodic account blocking for whatever reason.

Pros:

- Simple integration with Shopify

- Accessible in more than 200 countries

- Robust fraud prevention measures

Cons:

- Poor customer support

- Confusing transaction fees

4. Klarna

Unlike other solutions, Klarna is appreciated for a buy now, pay later structure, which is highly applicable among Commerce with expensive products. It offers a seamless checkout experience, easy integration, and low transaction fees. Also, Shopify store owners can get a complete payment at checkout!

But once you've got any issues or need a consultation, interacting with the support team might be really tricky and won't always fulfill your requests.

Pros:

- Improved conversion rate

- Various payment options available

- Simple and user-friendly checkout

Cons:

- Higher costs for merchants compared to competitors

- Customers may hesitate to use buy now, pay later

5. Amazon Pay

Amazon Pay is an excellent payment alternative for the Shopify store that features high-end security with the fraud protection system and is supported across a wide range of countries. Moreover, it offers a highly convenient customer experience during checkout, as it allows automatically inputting the customer details.

But, this option requires having an Amazon account and has certain restrictions due to compliance with Amazon's regulations.

Pros:

- Simple checkout process

- Low fees for merchants

- Cross-selling features

Cons:

- Limited to customers with Amazon accounts

- Funds withdrawal takes up to 14 days

6. Authorize.net

The main feature that makes Authorize.net stand out from the competitors is the robust fraud prevention and security attributes. Furthermore, the platform supports most of the common payment options like Visa, JCB, MasterCard, American Express, etc, and supports the digital payment options – ApplePay and GooglePay.

However, it features comparatively high service rates and a complicated user interface, which might seem confusing at first.

Pros:

- Mobile payments and e-check processing

- Excellent customer support

- Customized payment pages and receipt templates

- Various payment options available

Cons:

- Comparatively high fees

- Complex setup and integration

7. Elavon

Elavon is known among merchants in the US and UK as a reliable payment system for Shopify. It has online and offline modes and is extremely reliable and secure when handling customer transactions.

One of the major problems of this solution is a durable account verification that can take up to 5 weeks, during which any transaction cannot be processed.

Pros:

- Excellent customer support

- High security and reliability

- Easy to set up

Cons:

- Lengthy account verification

- Unexpected account closures

8. Verifone

Though not as popular as others listed, Verifone is a flexible payment solution that can adjust to your current business needs. It has free signup, charges for each transaction processed, and offers a convenient tax calculation that can't be overlooked.

However, its system structure doesn't fit Shopify store owners who sell products considered to be high risk.

Pros:

- Relatively low-cost

- Easy to integrate and use

- Secure and flexible

Cons:

- Not suitable for high-risk Shopify products

9. WorldPay

WorldPay will best fit the merchants needing a solution for online, over-the-phone, and credit/debit card payment methods. The system is available in over 100 countries and features top-notch fraud protection and a straightforward set up.

However, it offers only two subscription plans, and you might need to request a consultation to get more details about the system performance.

Pros:

- Extensive support for networks and software solutions

- Easy to implement and configure

- Available in more than 100 countries

Cons:

- Limited customer support

- Account setup involves long lead times

10. Square

Square is highly popular among Shopify store owners for its helpful extensions and different payment structures, including donations, membership fees, appointment scheduling fees, and standard transactions. The payments are usually received within 1 to 2 days, which is good from the business perspective.

Nevertheless, its accounts may experience stability issues, and the platform is comparatively expensive for large-scale eCommerce businesses.

Pros:

- No initial setup or monthly charges

- Fast transfer of funds to your bank account

- Excellent user experience

Cons:

- High transaction fees

- Limited customer support

As you can see, there are numerous Shopify payment processing options to choose from. You just need to select the one depending on your project’s needs and business objectives.

What to Consider When Choosing a Shopify Payment Gateway Solution

With so many payment gateways in Shopify, you may get confused about which is best for your business needs. To make the right choice, consider the following factors:

- Payment processing fees. Compare the per-transaction fees charged by different providers.

- Supported payment methods. Make sure your provider offers various payment methods Shopify, including credit cards, debit cards, Apple Pay, Google Pay, and other solutions.

- Security and compliance. Ensure your chosen gateway provides top-notch security and features PCI compliance and fraud prevention measures.

- Ease of setup. Look for payment providers that offer simple integration with your Shopify store.

- Integrations available. Opt for payment gateways that offer additional features and extensions like accounting software or analytics tools.

- Customer support. Consider the availability and responsiveness of the payment processor’s support team.

- Global reach. Ensure your chosen gateway is available in the countries you aim to sell your products in.

Features to Consider When Choosing a Shopify Payment Method

Once you've decided to choose a Shopify payment provider, you'll probably be drawn to various parameters and characteristics of the payment gateway. Nevertheless, there are still some essential features to mind before making your final choice:

- Customer Shopping Experience – make sure the payment system should provide a comfortable payment process for each of your clients. Consider choosing some of the Shopify alternative payment methods.

- Geographical Location of Target Market – opt for the solution that works for your target market

- Transaction Fees – compare the pricing to define the most cost-efficient option at the decent quality

- Accepted Payment Cards – choose the system that is compatible with most of the available credit and debit card providers (such as MasterCard, VISA, and American Express)

- Worldwide Availability – ensure the Shopify payment system potentially works for the global audience and allows the configuration of Shopify market settings

- Availability of Fraud Detection Features – check whether the payment method is secure, risk-free, and can timely determine the payment fraud

These aspects will help to define the best payment method for Shopify, which can ideally serve any eCommerce business.

How to Integrate Payment Methods on Shopify

In fact, integrating the payment methods in Shopify is pretty easy and doesn't require any specific expertise. Whether you decide to do it yourself or entrust it to professionals, implementing the payment system can be performed in just three essential steps:

- Select the best payment method for Shopify based on the core business preferences and customer needs

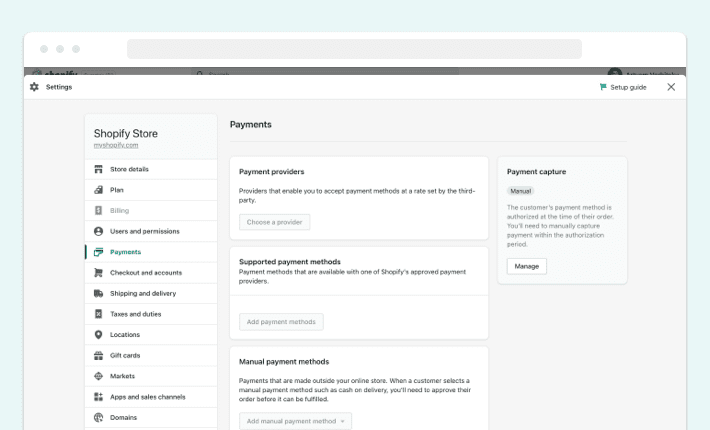

- Connect payment method to your Shopify store (go through "Settings" > "Payment Providers" > "Add a Provider", then activate Shopify Payments or choose any of the best third-party payment providers for Shopify)

- Make settings for the selected payment method by filling out the online form that you need to fill out with relevant information

After these steps, your clients can start making payments on your site!

Shopify Payments vs. Third-Party Providers

The final question to answer when analyzing the best Shopify payment methods is which option is the most effective from the eCommerce business perspective. The final decision will mainly depend on your target audience, business goals, and the methods available.

In our experience, Shopify store owners usually choose Shopify Payments. It’s an excellent payment gateway for small to mid-sized businesses and can also be a decent option for large-scale platforms in some cases. Shopify Payments is simple to use, comes with fewer charges, and provides a standalone payment solution with high-grade security.

Arthur Korniyenko

Founder and CEO of GenovaWebArt

Growing businesses that are focused within a certain niche, or have already obtained a huge customer base can also consider alternatives to Shopify payments.

In this case, the key elements to consider will be the customer preferences, pricing, and complexity of setting up and maintenance. Knowing all these parameters, business owners can make a profitable, data-driven decision for their eCommerce platform.

While choosing a Shopify payment method, make sure it supports the Express Checkout. This option allows customers to quickly get a product without inserting lots of personal information, significantly reducing the abandoned cart rate. The Shop Pay solution has a good Express Checkout feature with many customization options.

Need to Personalize Your Shopify Store? Contact GenovaWebArt!

Setting up the best payment processor for Shopify takes some time, but is surely worth the effort. By choosing the right third-party application for your Shopify website, you can ensure excellent customer support and experience with the maximum profit for your business.

We do hope that this guide has given you a basic idea of Shopify payment systems, as well as how to effectively implement them into your business. At the same time, you can now evaluate the potential of different solutions and better understand which one can work for you.

If you still have any questions concerning the Shopify payment methods or want to discuss which of the providers will be the most efficient for your business, contact GenovaWebArt! Our experts know all the secrets of setting up an efficient payment processing system and can help you make the most of your Shopify business right away!

We have already helped numerous projects select and integrate the right Shopify payment providers.

Thus, make sure to check our portfolio to see how we helped NYC-based sportswear brand Ten Thousand and beauty brand Winky Lux develop their eCommerce websites.

![Shopify ERP Integration: Pros & Flow [2024] - GenovaWebArt blog article, banner image Shopify ERP Integration: Pros & Flow [2024] - GenovaWebArt blog article, banner image](https://genovawebart.com/hubfs/img/webp/hero-banner-blog-article-shopify-erp-integration.webp)