Highlights:

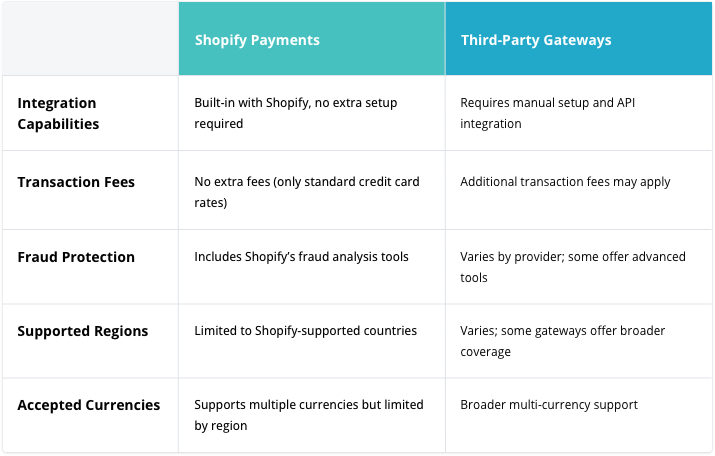

- Shopify Payments provides native integration and eliminates additional transaction fees.

- Third-party gateways for the Shopify platform offer broader regional support and multi-platform flexibility.

- Your choice should align with your business scale, location, and growth plans.

- Merchants don’t always have to use one or the other. Combining two or more options can be a better solution.

Shopify Payments vs. third-party gateways is one of the main dilemmas for ecommerce decision-makers. Shopify Payments offers seamless gateway integration. It also grants reduced fees for Shopify store owners. Meanwhile, third-party payment gateways compatible with Shopify provide flexibility for complex business needs.

Yet, there are many more nuances to consider for Shopify vs third-party payment gateway. The teams face the challenge of balancing functionality with cost, efficiency, and scalability.

In this article, we’ll explain the particularities of each option and everything you need to know about payment gateways for Shopify.

Our Shopify development experts know how to set up the payment functionality that will optimize both revenue generation and user experience. We’ve seen firsthand how the right payment gateway choice can transform business operations.

Find out the essentials of Shopify’s payment options and how to optimize them for your store. Learn more with GenovaWebArt.

What is a Payment Gateway?

A payment gateway bridges your online store and the financial institutions that process your customers’ payments. It encrypts sensitive data, authorizes transactions, and ensures secure money transfer from your customer to your merchant account.

A payment gateway serves several critical functions:

- Enabling security and trust.

- Supporting financial operations.

- Contributing to business growth.

- Shaping customer experience.

The right payment gateway can significantly enhance the following:

- Revenue – through better conversion rates.

- Customer satisfaction – through smooth transactions.

- Operational efficiency – through automated processes.

- Risk management – through fraud prevention.

Hence, selecting one is a strategic solution. For Shopify merchants, the choice is between Shopify Payments and third-party payment gateways. If you are in the early stages of planning a store launch, explore our guide. Get a comprehensive explanation of the steps to launch a Shopify store.

Shopify Payments: Quick Business-Oriented Overviews

Shopify Payments, powered by Stripe infrastructure, is the platform’s native solution. Its main advantage is integrity. It would be surprising if this gateway didn’t fit seamlessly into the setup. But let’s focus on more specific benefits and features of Shopify Payments.

Exclusive Integration Benefits

The seamless integration shapes user experience on several levels. Shopify Payments was developed to integrate exclusively with Shopify. Hence, it’s tailored to fully match the platform’s logic and architecture.

Integration with your store provides several critical advantages:

- Cost saving. All additional transaction fees are eliminated. The credit card rates are competitive and plan-based. Currency conversion is automatic. All of the above and unified billing result in reduced operational costs.

- Fraud protection. The gateway has built-in fraud analysis tools powered by Stripe. Risk assessment is automatic and applies to every transaction. There is real-time fraud monitoring.

- Analytics and reporting. There’s a unified dashboard for sales and payment data. Merchants can view detailed transaction history with advanced filtering and generate custom reports. Real-time payment status tracking is also available.

Cost saving is a logical benefit of using Shopify Payments. Meanwhile, you can say that Shopify takes user security and convenience into account, which is priceless.

Simplified Technical Management

The use of the native solution benefits technical teams. It reduces implementation and maintenance overhead. For example, basic implementation requires zero additional code. The checkout integration is pre-built. Security updates and compliance maintenance are automatic. You can learn more about the nuances of platform support in our ecommerce website maintenance guide.

A few other features that facilitate technical management are:

- Centralized order and payment management.

- Automated payout scheduling.

- Built-in test environment.

- Simple dispute resolution interface.

- Streamlined refund processing.

Geographic Coverage and Currency Support

Shopify Payments offers extensive support for different regions and currencies across the globe. It handles local currencies and payment methods in supported regions and offers robust conversion mechanisms.

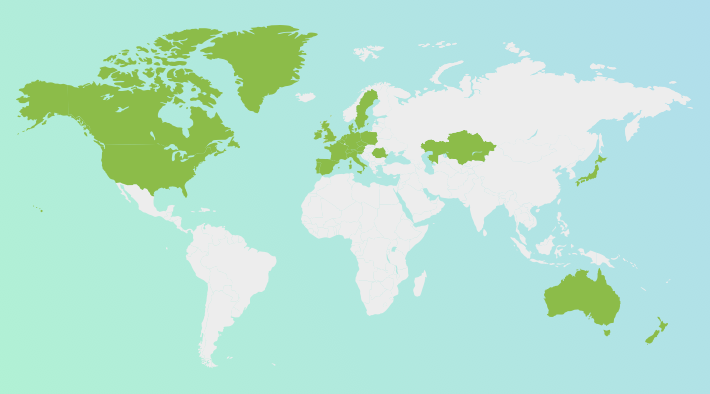

The regions that are currently supported include the following:

- North America: Canada, United States.

- Europe: Austria, Belgium, Czechia, Denmark, Finland, France, Germany, Ireland, Italy, Netherlands, Portugal, Romania, Spain, Sweden, Switzerland, United Kingdom.

- Asia-Pacific: Australia, Hong Kong, Japan, New Zealand, Singapore.

Shopify Payments supports more than 130 currencies with some regional restrictions. The exchange rates are updated automatically. Local payment method support is enabled in all regions.

The platform is gradually expanding its reach. Soon, you can expect more countries and capabilities. If the geographic factor is critical to you, learn more about Shopify international selling and how to manage it.

Additional Business Benefits

Beyond the core features, Shopify Payments offers several operational advantages. Those include:

- Better customer experience. The gateway supports an accelerated checkout process. Returning customers can save their payment information. All payment flows are optimized for mobile.

- Optimized business operations. Merchants get faster access to funds with predictable payout schedules. Sales tax calculations are automatic. The reconciliation process is simplified.

- Default risk management. Payment Card Industry compliance is handled by Shopify. Fraud prevention algorithms are sophisticated and perfected. The same goes for general security updates.

As you can see, Shopify Payments offers benefits that work on multiple levels. Peculiar attention to user experience on both the merchant’s and buyer’s side facilitates daily tasks for your team. More convenience and predictability with robust risk and security mechanisms boost effectiveness more than it may seem at first glance.

Third-Party Payment Gateways: Flexibility for Complex Needs

Businesses tend to seek alternative payment solutions to meet specific operational needs. Payment processors supported by Shopify provide additional flexibility and features that can be crucial for complex business models.

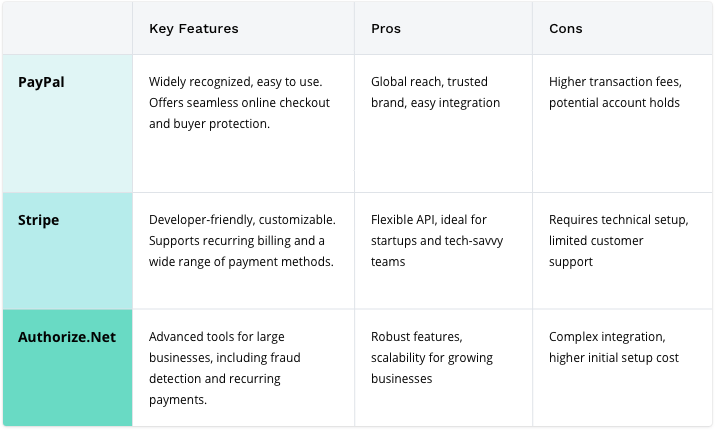

Some of the popular alternatives to Shopify Payments are:

- PayPal. It’s one of the oldest and most widely recognized online payment platforms. It accepts payments through PayPal accounts, credit cards, and debit cards. PayPal is particularly appealing for new and small ecommerce businesses.

- Stripe. It provides highly customizable payment processing solutions with robust developer tools and APIs. Stripe supports payments in multiple currencies. It offers extensive features like subscription billing and fraud prevention.

- Authorize.Net. This is a solution by Visa. It specializes in providing secure payment gateway services for businesses of all sizes. The platform has rich functionality. However, the setup is more complex compared to newer payment solutions.

Let’s look at the pros and cons of third-party payment options available for Shopify as compared to Payments.

Advantages of Third-Party Gateways Solutions

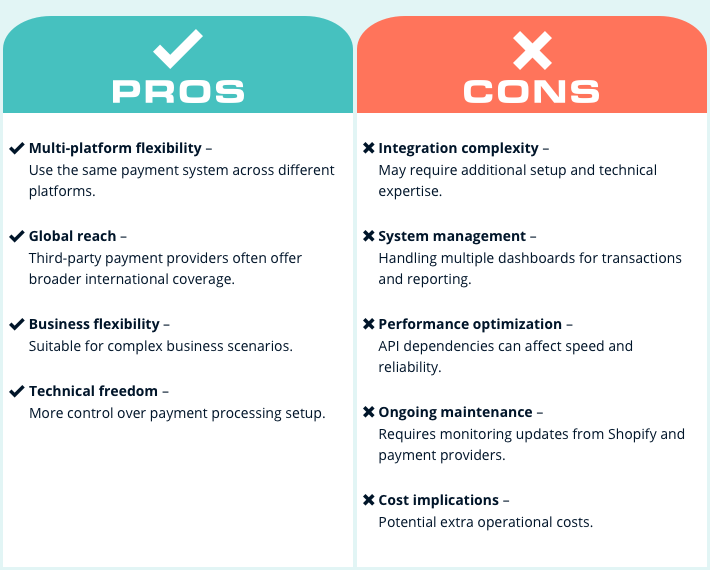

Businesses choose to use third-party payment gateways compatible with Shopify when they need a beyond-standard setup. Think about selling through multiple channels or running a complex business operation. These gateways adapt to various business models. The benefits you get with such solutions include:

- Multi-platform flexibility. You can use the same payment system across different platforms. This includes connecting the storefront with physical POS systems and integrating payments into mobile apps and social media stores. You get to keep consistent payment processing when expanding beyond Shopify.

- Global reach. Third-party payment providers often offer broader international coverage. For example, PayPal operates in over 200 markets. This extensive reach can help you enter new markets quickly. Third-party payment providers compatible with Shopify usually support regional preferences regarding local payment methods.

- Business flexibility. Third-party gateways excel at handling complex business scenarios. A B2B company might need detailed invoice processing. A subscription business requires recurring billing options. Global brands need support for regional payment methods. These gateways provide tools and plugins for each case.

Long story short, payment processors supported by Shopify can be a universal and flexible solution for your business. Built for integration with various platforms and services, they are more likely to offer the integration adjustments you might need.

Challenges of Using Third-Party Gateways

Despite all benefits, third-party payment gateways compatible with Shopify introduce several technical complexities that businesses must carefully consider.

- Integration complexity. Third-party gateways may require substantial development effort and technical expertise. The technical team will need to manage API integration, test and validate the solution, check data flow systems, etc.

- Security requirements. Most gateway providers offer robust security features. Still, your team becomes responsible for maintaining compliance and updates across the integration points.

- System management. Third-party integrations often require managing multiple dashboards and reconciling data across different systems. It complicates troubleshooting efforts and increases the time needed for daily operations.

- Performance optimization. Constant API calls can introduce latency and undermine reliability. You’ll need to implement robust error handling, establish reliable backups, and regularly monitor performance metrics.

- Ongoing maintenance. You need to watch for regular updates from both Shopify and the payment gateway. This requires dedicated technical resources. It can also impact your development team’s availability for other projects.

- Cost implications. The factors above translate into extra operational costs. On top of that, you need to consider emergency support resources, staff training, etc.

Explore a detailed breakdown of Shopify-compatible payment methods with our overview of more Shopify payment integrations.

What Motivates Businesses to Switch to Shopify Payments?

The comparison between Shopify Payments and third-party payment gateways helps understand each option better, but it doesn’t always answer clearly which one is best you.

Shopify is a flexible and democratic platform. The use of native solutions is not a requirement. Shopify doesn’t purposely limit functionality, nor does it undermine business opportunities for those using third-party apps.

Yet, many businesses prefer Shopify Payments due to its convenience and overall positive experience with the platform’s own tools. It is only logical that Shopify will aim to offer better terms and extensive opportunities for merchants choosing its native solutions. In particular:

- Shopify Payments provides multi-currency operations. It allows for currency conversion regardless of the client’s region.

- With third-party solutions, merchants need to set local prices manually. An alternative option is using additional payment gateways.

- Subscription management is more integrated and easier to administrate with Shopify Payments. It also comes with lower commissions.

The convenience of Shopify Payments and related savings have motivated many businesses to switch to this option. Our clients are among those opting for the benefits and convenience of native integration.

Learn how successful Shopify stores reach their business goals. Explore our case studies for inspiration and practical tips.

Which Payment Gateway Should You & How To Choose?

So, when is it better to use third-party payment processors with Shopify, and when to opt for the native one? Consider the following factors.

1) Operational efficiency. Your payment gateway choice significantly affects daily operations and team productivity. Consider how the solution will integrate with your existing workflows. Estimate what impact it will have on your customer service and accounting teams.

Key operational factors to evaluate:

- Integration with existing business tools and processes.

- Ease of transaction monitoring and reconciliation.

- Customer service access and support quality.

- Reporting capabilities and data accessibility.

- Staff training requirements.

2) Scalability. As your business grows, your payment gateway needs to grow with it. Consider your expansion plans. Ensure your chosen solution can support your future needs without requiring a complete system overhaul.

Growth considerations include:

- International market expansion capabilities.

- Multi-currency transaction processing.

- High-volume transaction handling.

- Additional payment method integration.

- Cross-platform scalability.

3) Expenses. Understanding the true cost of a payment gateway goes beyond basic transaction fees. A comprehensive analysis should cover both immediate and long-term financial implications.

Essential cost factors:

- Standard transaction fees and pricing tiers.

- Currency conversion rates and fees.

- Integration and maintenance costs.

- Chargeback and refund fees.

- Monthly or annual fixed costs.

4) Security and compliance. Payment security is non-negotiable. Your chosen gateway must provide robust security features while helping you maintain compliance with relevant regulations.

Critical security elements:

- PCI DSS compliance support.

- Fraud prevention capabilities.

- Data encryption standards.

- Regional regulatory compliance.

- Customer data protection measures.

There’s no simple answer when it comes to choosing payment integrations. The most straightforward recommendation in this specific case would be:

- Go with Shopify Payments if you operate in the supported region and seek simplicity and cost savings.

- Go with a third-party gateway if you need flexibility, multiple payment options, and broader regional support.

As for in-store payment solutions, you may want to consider Shopify POS. If you are interested in learning more about the payment setup for retailers, check out one of our previous posts on Shopify POS features and cost.

Bottom Line

Shopify Payments is the most valuable option for businesses that prioritize simplicity and convenience. It requires quick setup, minimal technical overhead, and consolidated payment and order management.

Third-party payment gateways compatible with Shopify become the preferred choice for businesses with specific requirements or complex operations. They better serve organizations that want platform independence, need extensive customization options, or operate in regions not supported by Shopify Payments.

The choice of a Shopify payment processing solution for your store ultimately depends on your specific context. Consider business objectives, technical requirements, and growth plans. Understanding those will guide you toward the most suitable solution.

Meanwhile, a misaligned choice can lead to operational inefficiencies, unnecessary costs, and limited scalability. And remember: your payment gateway should not only meet your current needs but also support your future growth plans.

Looking for ways to enhance your Shopify store? Check out our resources to discover actionable insights and recommendations that drive success.

![Shopify ERP Integration: Pros & Flow [2024] - GenovaWebArt blog article, banner image Shopify ERP Integration: Pros & Flow [2024] - GenovaWebArt blog article, banner image](https://genovawebart.com/hubfs/img/webp/hero-banner-blog-article-shopify-erp-integration.webp)